Compiled by Director Kelsey Bergfeld and Policy Associate Sarah Hudacek

On Monday evening, the House Finance Committee released Substitute House Bill 33, which includes the first round of the House’s amendments and changes to the Governor’s Executive Budget. These changes are the culmination of more than two months of testimony before House Finance subcommittees from hundreds of witnesses.

AOF and our members have poured over these changes all week, and even though we’ll see another round of changes early next week in the omnibus amendment, we’re sharing all the good, the bad and the missing from the Sub-Bill.

Broadband: In the Department of Development, a new Broadband Pole Replacement and Undergrounding program was added to bury fibers and replace poles in unserved areas, defined as areas with less than 25 Mbps download and 3 Mbps upload speed access. This funding was infused with $10 million in American Rescue Plan Act (ARPA) State Fiscal Recovery Funds (SFRF) in fiscal year 2024. The definition of unserved areas as having less than 25/3 Mbps access, along with the goal of access to 100 Mbps symmetrical service is a first for Ohio, and a transformative step in recognition of the need for the highest-speed internet in order to work, attend school, access telehealth, connect with family and friends, and more.

Taxes: An income tax cut was expected to be included in the House’s changes, so we weren’t surprised to see the elimination of a tax bracket, which will cost the state upwards of $400 million in lost revenue each fiscal year.

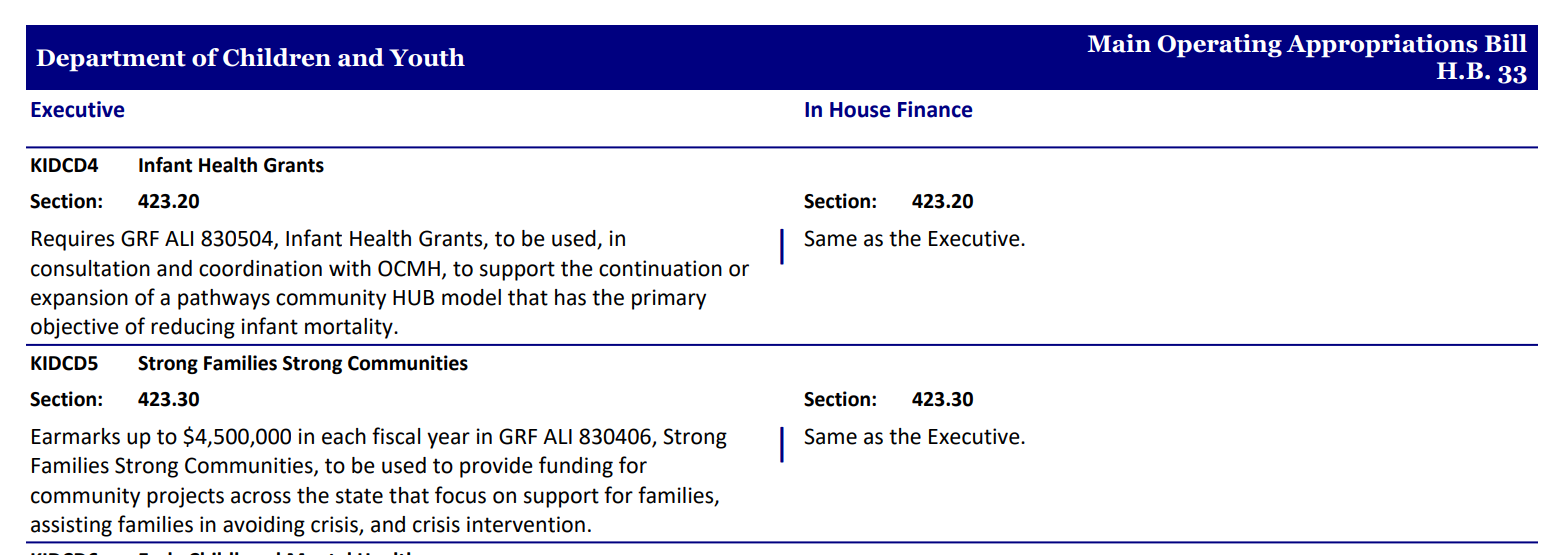

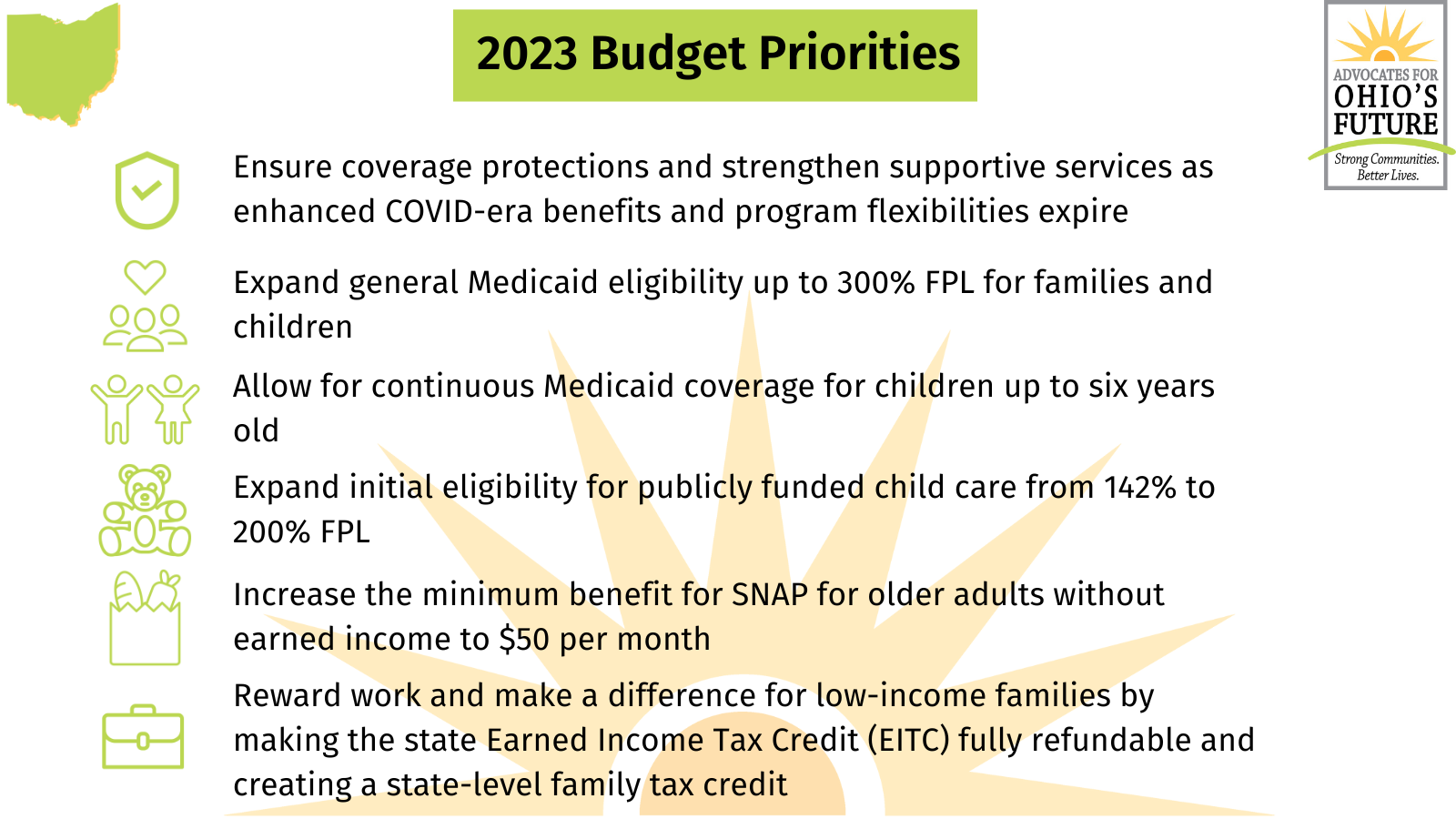

Children and Youth: Advocates were uncertain how the House would respond to the Governor’s proposal to create a new cabinet-level department, the Department of Children and Youth (ODCY). However, ODCY was maintained in the House Sub-bill, along with the expansion of initial eligibility for Publicly Funded Child Care (PFCC) from 142 percent of the poverty level to 160 percent, and the $114 million per fiscal year allocated for early childhood education. Unfortunately, $150 million in ARPA SFRF funding was removed from the Department of Job and Family Services budget, and early childhood mental health and Help Me Grow saw cuts, as well. Join Groundwork Ohio’s action alert HERE.

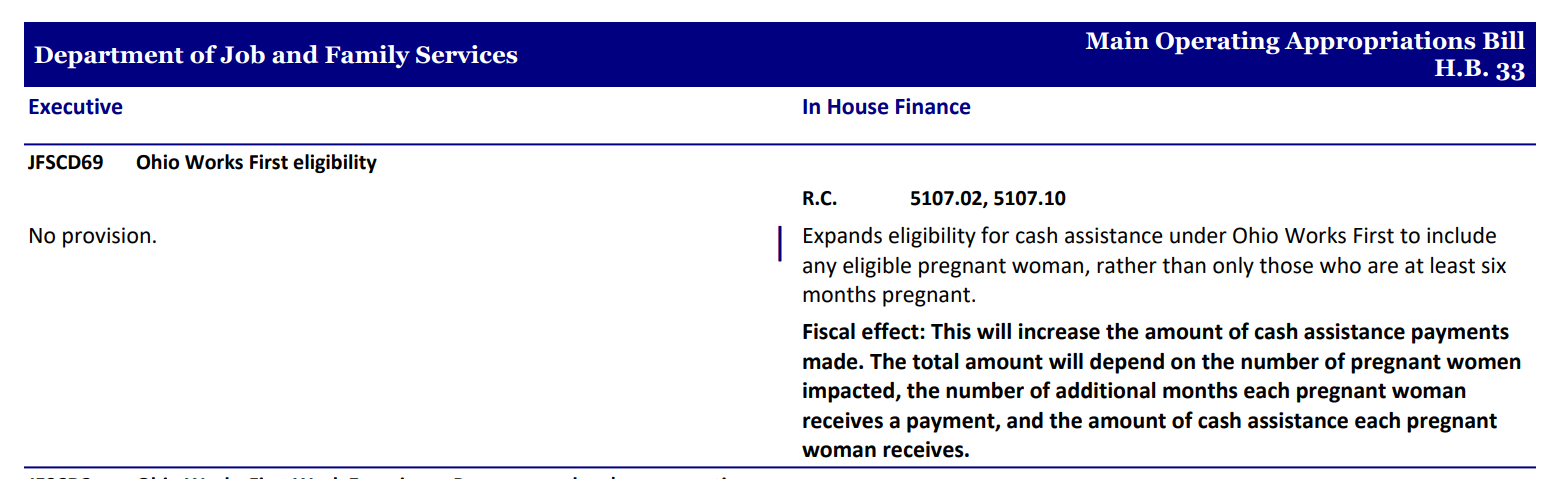

Ohio Works First: Eligibility for Ohio’s Temporary Assistance for Needy Families (TANF) cash assistance program, Ohio Works First (OWF) was expanded in a rare but welcome move in the House changes. If implemented, any pregnant person would be eligible for OWF benefits, whereas now, Ohioans are only OWF-eligible once they pass 6 months of pregnancy.

School Meals: AOF is a member of the Hunger Free Schools Ohio coalition, which advocates for free, healthy school breakfast and lunch for all Ohio students. In a great first step towards decreasing hunger in Ohio’s schools, the House included a provision in the budget for the state to reimburse schools for the cost difference between reduced-price and free meals. This would mean that any student who is eligible for reduced-price meals would automatically receive free meals instead. AOF continues to support the Hunger Free Schools coalition in pushing for free school meals for all, but we celebrate this initial win.

Direct Care Workers: After an incredible, months-long advocacy effort by advocates, direct care workers, providers, and Ohioans eligible for services, the House included a further increase in wages for home and community-based services direct care workers to an average $17 per hour in FY24 and $18 per hour in FY25. We are celebrating this historic increase with our partners, but continuing to advocate for the requested $20 per hour minimum wage for direct care workers and a 20 percent wage increase for behavioral health workers.

Doula Coverage: Our partners at the Center for Community Solutions and Children’s Defense Fund Ohio have been advocating for Medicaid coverage for doula services for years over the last three general assemblies. Finally, Medicaid coverage for doulas was included in the House changes.

Continuous Medicaid Coverage: As part of the his Bold Beginnings Initiative, Governor DeWine has supported the addition of continuous Medicaid coverage for kids up to age 6. The House, however, included continuous coverage for eligible children from birth until their 4th birthday. Although not the six years we were hoping for, this is a huge step forward that will help Ohio children access needed care and services during their most formative years. And, the expansion of Medicaid eligibility for pregnant mothers and children up to 300 percent of the poverty level was left in.

Medicaid Rate Increases: We also saw Medicaid provider rate increases for ambulance transportation, dental and vision care - all long overdue!

Lead Abatement: Funding for lead abatement, which includes the state lead safe home fund, was cut by $6.5 million each fiscal year, cutting lead abatement funds almost in half.

School Resource Officers: Governor DeWine’s as-introduced budget included $400 million for school resource officers (SROs), who are police officers with limited additional training in order to be posted in schools. Our partners at Ohio Poverty Law Center, Policy Matters Ohio, Juvenile Justice Coalition, and Children’s Defense Fund Ohio held a powerful press conference earlier this month on why SROs are not a viable solution and how the presence of SROs has a disparate impact on students of color. Thankfully, the SRO provision was removed by the House!

Child Tax Deduction: The House also removed the Governor’s $2,500 per child tax deduction. Although AOF wishes that this would have been replaced with a Thriving Families Tax Credit or a refundable Earned Income Tax Credit, we’re supportive of this deduction’s removal, which would have had miniscule impacts on low-income families.

Children’s Services Cuts: The sub-bill included cuts of $28 million in FY24 and $25 million in FY25 to critical programs and services for foster children, youth, families, and public children services agencies. These cuts will impact the Ohio Kinship and Adoption Navigator Program, the Kinship Support Program, the Bridges program for foster youth transitioning into adulthood, the Ohio START program, Tiered Foster Care, the Triple P prevention program, and more.

Housing: The House changes included a more robust state affordable housing tax credit proposal, but also added a requirement that the Ohio Housing Finance Agency secure approval from county commissioners before financing any affordable housing projects. Communities are already bogged down by Not In My Back Yard attitudes that hinder the development of affordable housing in communities that desperately need it. The Coalition on Homelessness and Housing in Ohio is urging this provision be removed.

What’s Missing: AOF and our partners advocated for a number of investments that have not yet been included in the budget, including: